Tax Planning

We analyze your tax situation and proactively recommend strategies that save you taxes now and in the future.

Current tax analysis

We review your current situation and your tax return annually with a focus on tax-savings opportunities.

Future tax savings

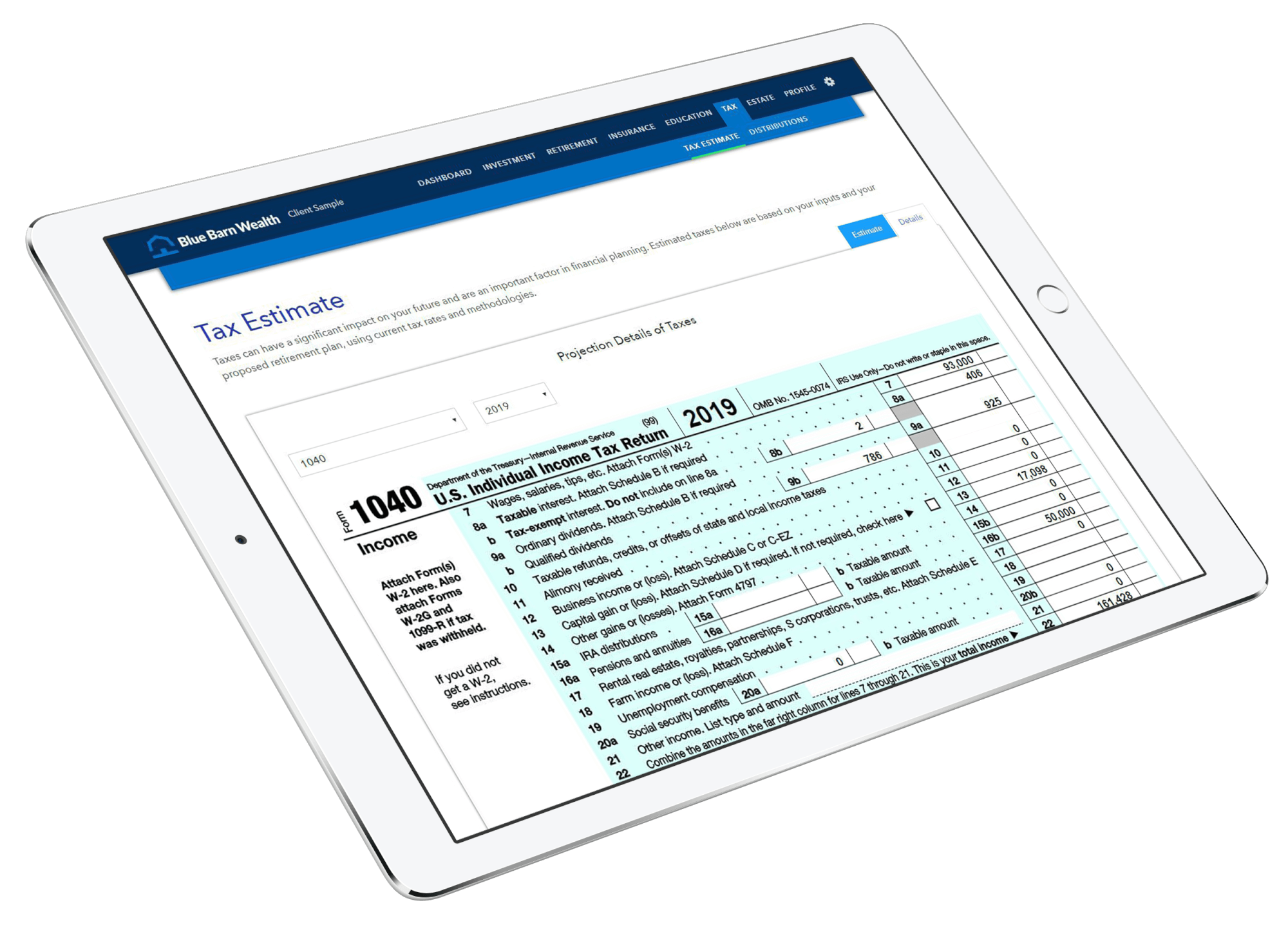

Using tax planning software, we project ways to save taxes in the future.

Tax-efficient strategies

Tax-efficient withdrawal plans, tax-loss harvesting, Roth conversions, minimize taxes on investments and more.

Specialized expertise

With a CPA and CFP(R) professionals in-house we have the expertise to provide real tax planning.

Tax savings over a lifetime

With our tax expertise, we identify planning, saving and distribution strategies that aim to lower your taxes over time. We excel at taming the complexity of taxes so you can live a more simple, intentional and meaningful life.

Minimize taxes. Maximize wealth.

No one likes to pay more taxes than necessary. We work to understand your unique situation to help you minimize your taxes, so you can focus on what matters most.

-

Simplified decisions

We help you make sense and develop a straightforward plan out of the complexity of taxes.

-

Up-to-date knowledge

We analyze changes to the tax code to offer you the best available planning strategies.

Tax-planning process:

-

Gather information

We believe good tax planning begins with good information. Annually, we gather your most recent tax returns as well as information about your current and future expected income and expenses, which we use as a basis for all our tax-saving recommendations.

-

Analyze situation

After gathering the necessary information, we analyze your most recent tax returns through the lens of your overall wealth and goals as we look for opportunities to either reduce taxable income or increase overall deductions and tax credits, which in turn reduces your tax liability.

-

Tax recommendations

Based on our review of your tax returns and current laws, we use our tax planning software to project the effects of different tax-planning strategies. We proactively identify specific recommendations that minimize taxes now and in the future.

Get started

Let us help you simplify your taxes and maximize your after-tax returns and income so you can use your energy to focus more on what brings you purpose.