The second quarter of 2024 had mixed results across the major indices with the S&P 500 increasing by 4.28%, the Dow Jones Industrial Average decreasing by 1.27%, the mid and small cap indices declining, and the MSCI EAFE International Developed down 0.42%.

Economy

At the beginning of the year, the consensus expected several rate cuts with some predicting as many as six rate cuts by the end of the year. Due to persistent inflation that has just recently shown signs of softening, interest rates have remained at elevated levels.

Current expectations are for one rate cut in 2024, with the Fed’s ability to cut near the presidential election in question.

Inflation

The year-over-year Consumer Price Index declined in Q2, with the last CPI reading of the quarter showing consumer pricing cooling slightly month-over-month in May and year-over-year inflation running at 3.3%. Core CPI (which removes more volatile food and energy from the metric) dropped to a three-year low of 3.4% in May, potentially bolstering the case for rate cuts.

Labor Market

Labor markets remained mostly steady to higher throughout Q2, with payroll gains (206,000 in June, 272,000 in May, 175,000 in April) in each month and June and May data beating analyst consensus expectations.

For June, the unemployment rate rose to 4.1%, higher than the estimated 4.0% and the highest level since November 2021. The unemployment rate has inched higher each month for the past three months, which is a potential sign that the Fed’s interest rate hikes have slowed the U.S. economy.

Quarterly Fed Expectations

The second quarter featured two Federal Reserve (Fed) policy meetings. The Fed left rates unchanged both times, in line with market expectations. The result is a current target overnight lending rate of 5 – 5.25%.

More importantly, the Fed has set expectations that it will cut rates only once in 2024.

In the third quarter, there will be two Fed meetings: July 31st and September 18th. As of early July, markets were pricing a 93.3% probability of no rate cut in July and a 70.8% probability of a 25-basis-point cut in September, per the CME FedWatch Tool.

Pre-Election Rate Cut Debate

Even with a 70.8% probability of a Fed rate cut at the September meeting, much controversy surrounds such a cut, as some market participants argue that a cut could bolster the economy and show potential favoritism to the incumbent. This will likely remain a topic of discussion the Election Day approaches.

Treasuries

Courtesy of slowing inflation data and Fed rate cut expectations, Treasury yields fell in the second quarter by more than 30 basis points from their April peak, ending the quarter near 4.37%.

As a result, holders of bonds have seen some well-deserved price appreciation since April. The Morningstar Core Bond Index gained 0.17% for Q2, and high-yield bonds tacked on 1.07% for the quarter, with the longer end of the curve lagging the shorter-term counterparts.

Generational Opportunity in Bonds?

It has been a rough patch for bond investors, to say the least, but there is hope!

Is it so bad that it is good? Some experts say yes. It has been 46 months since the bond market made an all-time high.

Looking at the Bloomberg US Aggregate Bond Index’s largest drawdown periods from 1976-2024, we can see that this drawdown has reached extreme levels. Should inflation continue to decelerate or decrease, it could be a time when smart money looks to bonds, given the value proposition.

Not as trendy as AI-fueled stocks, bonds do stand the test of time, and there is ample math that supports these fixed-income assets.

Forgotten Yield Curve Inversion

The longest yield curve inversion in U.S. history passed the two-year mark on July 7th. Seemingly forgotten as of late, the abnormal phenomenon has historically portended economic contraction or recession, but those who have banked on that thus far have missed a large rally in equities.

It is election season, so anything is possible moving forward.

Wall Street Wisdom Debunked

The classic Wall Street adage of “Sell in May and Go Away” did not transpire in the second quarter — for the second year in a row!

That’s right. Despite the higher interest rate environment, an inverted yield curve, and seasonality, the S&P 500 was positive for two out of three months in the second quarter. After declining by 4.16% in April, the S&P 500 added 4.80% in May and 3.47% in June, a solid quarter for the broad market average.

Tech and artificial intelligence (AI) continue to outperform the broader market, and AI-fueled gains were a prevailing narrative once again in the second quarter.

Technology Strength, Materials & Industrials Lag in Q2

On the subject of Artificial Intelligence and technology, Table 3 at the end of this report shows that the two highest performing sectors for the quarter were Information Technology (13.81%) and Communication Services (9.37%). Whereas, Industrials (-2.90%) and Materials (-4.50%) were the two lowest performing sectors for the quarter.

Dividend Stocks Lag in Q2: Turning Point Ahead?

With the ten-year yield near 4.268% and the two-year yield higher at 4.624%, blue-chip dividend-paying stocks have lagged as their trendier tech and AI counterparts have caught massive inflows of investor cash.

But those who have been around the markets for a while know that trends can be temporary, and U.S. giants like Coca-Cola, Disney, and 3M, for example, have stood the test of time and will not be going anywhere anytime soon.

Should interest rates decline, as many expect, dividend-paying stocks could once again come back into favor. We see that defensive sectors like utilities did well in the second quarter — perhaps a sign of things to come.

From Q2 to Q3: A Summary

Of course, much attention will continue to be paid to inflation data and the Federal Reserve. The Fed has broadcast its intentions for one rate cut in 2024, with the CME FedWatch Tool showing current expectations for one in September. The presidential election later this year adds an element of uncertainty to trying to “time” an interest rate cut.

But, putting those two things aside, portfolio diversification and a long-term focus have yielded positive outcomes over time. Some active participants may seek to look outside of tech and AI in Q3 to reduce portfolio volatility, be first in line to some dividend-paying blue chips, and perhaps in the beaten-up bonds/fixed-income products.

Diversification lowers volatility and smooths out the ride to becoming a successful long-term investor. We recommend remaining focused on the long term which allows you as an investor to avoid getting caught up in quickly changing narratives that could trigger emotional decisions.

Please reach out to us if you have any questions about this market update or your financial plan. As always, we truly appreciate the opportunity to serve you.

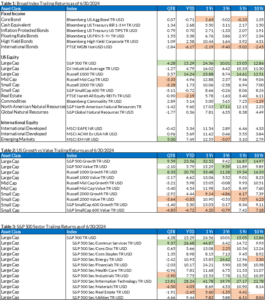

Index Trailing Returns

Source: Morningstar

(Green values are the top two values in each column; the orange values are the bottom two values in each column for each table)