The 2nd quarter of 2023 showed positive returns in most equity asset classes with mixed results in fixed income. Inflation, compared to the same period in 2022, has continued to trend downward, causing market participants to believe that interest rates will not need to go much higher from current levels. Technology and growth stocks continued their outperformance from the 1st quarter, making significant progress at recovering some of the losses experienced in 2022.

S&P 500: Make It Three Consecutive Positive Quarters

The second quarter of 2023 was the third consecutive positive quarter for the S&P 500 and the Dow Jones Industrial Average. The Nasdaq 100 was the biggest gainer of the three major indexes in the second quarter, with AI and large-cap tech fueling gains.

For the second quarter of 2023, the S&P 500 increased by 8.74%, the Nasdaq 100 rose by 15.32%, and the Dow Jones Industrial Average saw an uptick of 3.97%.

Economy

Investors shook off the banking turmoil that was front and center in the first quarter.

A Federal Reserve-induced recession is still a distinct possibility, as interest rates remain elevated, and tightening credit is making its way through the markets. However, that did not come to pass in the second quarter, as major U.S. stock indexes traded positively.

Inflation

Inflation metrics continued to decline in the second quarter, with Consumer Price Index data showing monthly consumer pricing declining in May from April levels. Year over year, inflation slowed to a 4.0% rise. In comparison, the year-over-year metric just a few months ago was 6.0%.

Core CPI (which removes food and energy) remains firm, potentially backing the Fed’s case for additional rate hikes. Even so, U.S. equity markets rallied as headline inflation metrics ticked lower throughout the second quarter.

Labor Market

Strength persisted in labor markets throughout the second quarter, with solid payroll gains (253,000 in April and 339,000 in May), both numbers beating analyst consensus expectations.

In April, the unemployment rate tied for the lowest level since 1969, at 3.4% vs. 3.6% estimates. For May, the unemployment rate rose to 3.7%, higher than the estimate of 3.5%. Perhaps this was a factor in the Fed not raising rates in June.

As inflation readings decline, it is natural to expect some slowing in the labor market. As of the second quarter, the labor markets remained steady overall, and America’s labor shortage continues, despite recent declines in the number of job openings.

Quarterly Federal Reserve (Fed) Actions

The second quarter featured a 25-basis-point hike in May and no hike at the June meeting, with the Fed taking a breather after ten consecutive rate hikes.

The third quarter has two Fed meetings: July 26th and September 30th. The Fed has indicated two more hikes for 2023, and many analysts seem to agree. The July meeting brought one of those hikes, increasing rates by 0.25%, which puts the target range for the federal funds at 5.25-5.50%.

Treasuries, Inversion, and Recession

Treasury yields rose overall in the second quarter after taking a breather towards the end of Q1. The benchmark 10-year yield settled near 3.82% to end the second quarter, up from its 3.49% yield to close out the first quarter.

Shorter-term Treasury yields have risen more precipitously than their long-term counterparts lately, with the 2-year note yielding 4.90% and 1-month bills yielding close to 5.187% at the close of June.

The 2/10 yield curve has been inverted for an extended period (over a year), meaning the 2-year Treasury note yields more than the 10-year Treasury note. This inversion is a classic sign of a recession and often comes with a delayed fuse. Investors have tended to ignore this phenomenon in recent weeks and months, as stock prices in general continue to rise.

Technology Strength, Cruise Operators Shine

Artificial intelligence (AI) and tech have continued to lead the markets in our evolving society. However, cruise operators were the S&P 500’s best performers in Q2, suggesting pent-up travel demand persists!

Monthly Themes

Entering the second half of the year, here is a recap of monthly themes in Q2:

- Major U.S. stock indexes traded lower in April as markets braced for additional interest rate hikes; overall prices consolidated in then-recent monthly ranges.

- May saw technology break out of recent reading ranges, with the Nasdaq surging.

- In June, the stock rally started to broaden, featuring a breakout by the broad-based stock index, the S&P 500.

In Summary

Active participants are currently debating whether the market is getting ahead of itself, given some of the macroeconomic headwinds. But these same folks more than likely missed this recent stock market rally. This is a big reason to be a long-term investor: timing the market is very difficult, and many get left behind when trying to do so.

Remaining focused on the long term allows an investor to avoid getting caught up in quickly changing narratives that could trigger emotional decisions.

With that said, if second-quarter market developments are on your mind, or if there is anything else where we can help, please reach out. We’re always here as a resource.

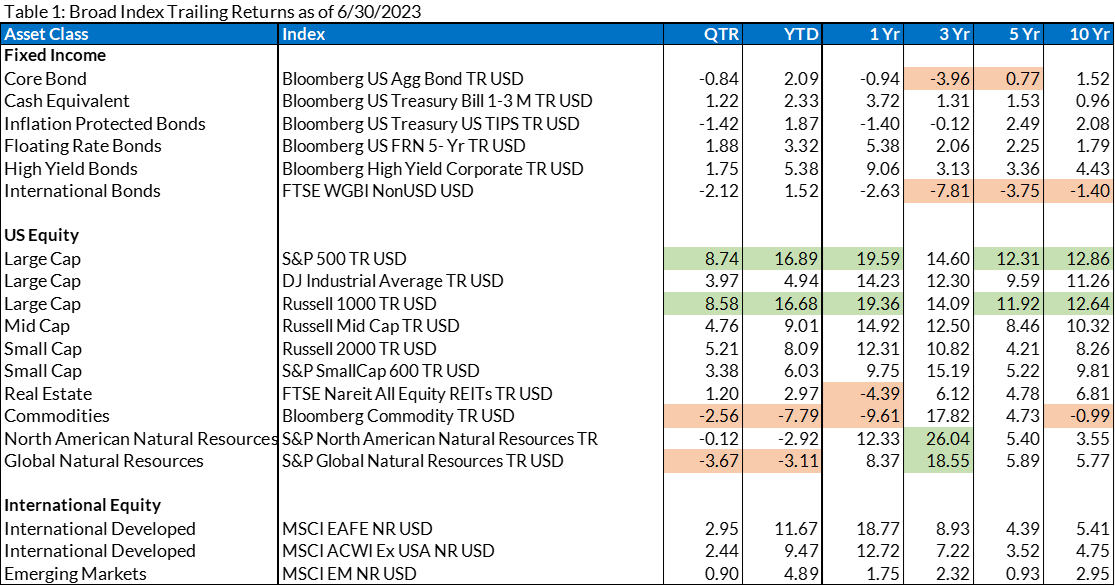

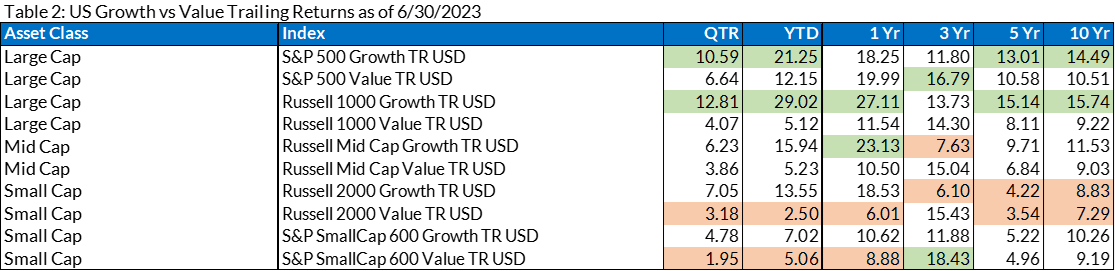

Index Trailing Returns

Source: Morningstar

(Green values are the top two values in each column; the orange values are the bottom two values in each column)