The first three months of 2023 provided a partial recovery to last year’s sell off in equities and fixed income. China removing its COVID restrictions and opening its economy was a catalyst for both international and domestic stock markets. Large U.S. stocks, as measured by the S&P 500, finished the quarter up 7.5%, and International Developed stocks, as measured by the MSCI EAFE, were up 8.47%.

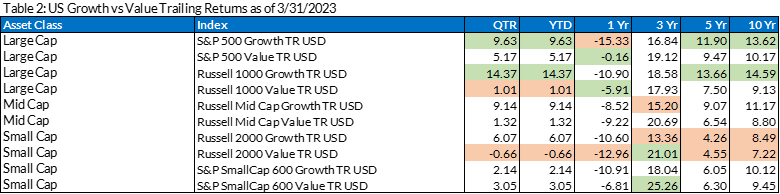

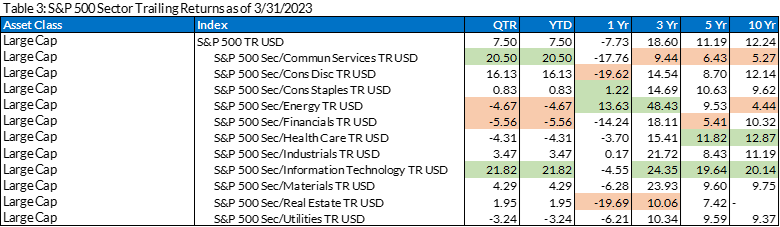

In the U.S., Technology and Communication Services led the recovery for the quarter with Natural Resources and Commodities posting a negative return. This reversed the trend in 2022, where Natural Resources and Commodities significantly outperformed other industries, and Technology and Communications were two of the worst performing. After strong equity returns in January, concerns about higher interest rates, inflation, and bank failures erased most of the gains in February through March 13th. In the final two weeks of the first quarter, equity markets rallied to recapture the gains.

Bonds clawed back some of the losses from 2022, with core bond portfolios returning around 3% for the quarter. This was driven by higher yields and a slight drop in interest rates over the quarter for all maturities 1 year or longer.

Looking forward, a key question is whether the U.S. economy will experience a recession in the 2nd half of 2023. The minutes for the March Federal Open Market Committee Meeting included this statement, “Given their assessment of the potential economic effects of the recent banking-sector developments, the staff’s projection at the time of the March meeting included a mild recession starting later this year, with a recovery over the subsequent two years.” The rapid increase in interest rates is intended to slow the economy down and return inflation to its target of an annualized 2% rate. However, as demonstrated by the stress on bank balance sheets, the change in interest rates may have additional consequences that reduce economic activity further than intended.

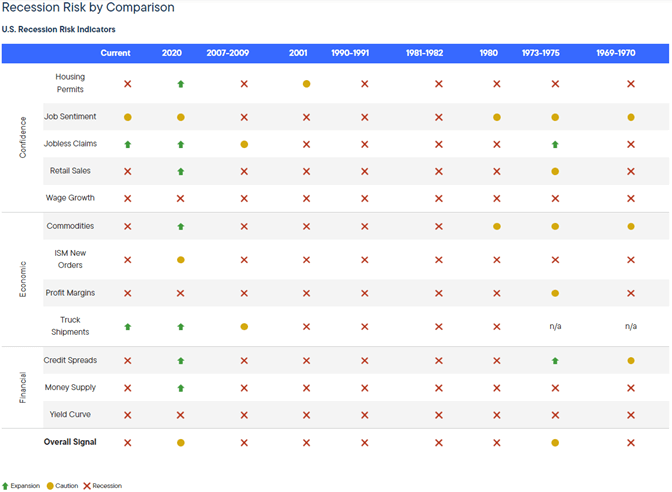

A traditional definition of a recession is “a significant decline in economic activity that is spread across the economy and that lasts more than a few months.” Franklin Templeton, an investment firm, has a program they call “Anatomy of a Recession” in which they track specific characteristics of the economy over time to see how likely we are to have a recession. Chart 1 shows how these characteristics have changed over the past year. Chart 2 shows how these characteristics compare to previous recessions going back to 1969. In these charts, a red x indicates the characteristic is in a range similar to prior recessions, a yellow circle shows it is getting close, and a green arrow indicates a value seen in prior periods of growth.

As can be seen from the chart, most of the characteristics have deteriorated over the past twelve months and are now indicating recession. Truck shipments and jobless claims are the two characteristics that still indicate growth. So, there is still uncertainty about whether the U.S. will experience a recession in the next 6 months and if so, how severe it will be and how investments will be impacted.

Chart 1: Franklin Templeton Recession Indicators: June 30, 2022 – March 31, 2023

Chart 2: Franklin Templeton Recession Indicators: Current Compared to Previous Recessions

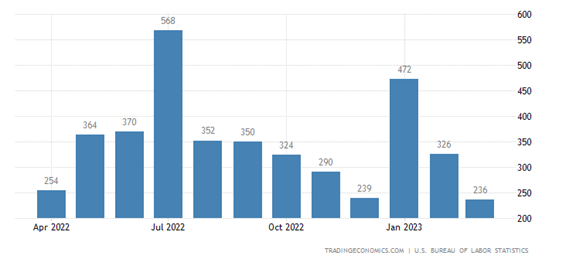

The labor market in the United States remains strong and wages continue to rise but at a slightly slower rate. Chart 3 shows the increase in people employed in the United States by month. Normally during a recession there would be job losses, which could happen later this year but for now, the economy is still adding jobs.

Chart 3: Increase in United States Non-Farm Payroll Positions (in thousands)

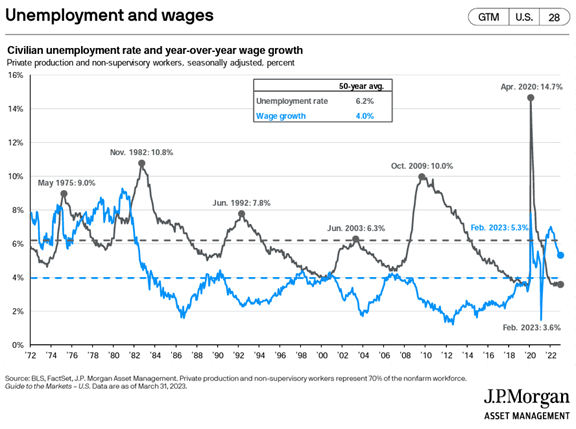

The current unemployment rate is 3.6%, which is the lowest it has been in the past 50 years and well below the average of 6.2%. Wage growth is at 5.3%, which is the highest it has been since 1882 and is well above the 50-year average of 4.0%. The trend of a strong labor market with low unemployment and high wage growth may decrease the likelihood or severity of a recession.

Chart 4: U.S. Unemployment Rate and Wage Growth

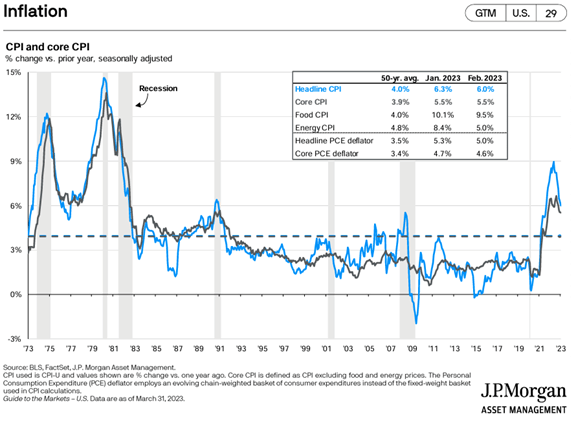

Inflation, as measured by Core Consumer Price Index (CPI), remains above the 50-year average of 3.9% and well above the Federal Reserve target rate of 2% (see Chart 5). It appears that price increases are more persistent than expected and that it will take more time and possibly higher interest rates to stabilize prices.

The first quarter featured one Fed meeting in March, resulting in a 25-basis-point hike. The hike was largely expected, although some participants wanted to see a pause in the wake of the banking turmoil. The second quarter features two Fed meetings on May 3rd and June 14th, with continued rate hikes possible. However, rate hikes are not the only tools at the Fed’s disposal. The Fed could also use Open Market Operations (OMO), such as selling bonds, to reduce liquidity in the system.

Some believe that the Q1 banking turmoil had a similar effect as a rate hike, since credit markets tightened after the collapse of Silicon Valley Bank (SVB). Tighter credit markets could help to slow the economy. Thus, market expectations have seemingly shifted towards a gentler Fed for the remainder of 2023, with one more rate hike being the consensus and in line with what the Fed has forecasted. There is also debate as to whether interest rate cuts may be required later in the year.

Chart 5: United States Inflation Rate since 1973

Takeaway

There are many indications the U.S. could experience a recession in the 2nd half of 2023, which would likely lead to job losses, higher unemployment, and reduced economic activity. If this occurs, the impact on investment portfolios is not clear. It seems logical to think that a recession equals poor portfolio performance. However, market participants are forward looking, and stock market performance is usually a leading indicator for recessions, meaning stocks often start to drop before a recession starts and begin recovering before a recession ends. As such, it may be the case that market participants are already looking past a possible recession to the economic growth that would follow.

We do not recommend trying to time when the recession will occur and making drastic portfolio changes to avoid losses. Amid all the first-quarter speculation and turmoil and a possible recession later this year, remaining focused on the long term is even more important. A long-term focus prevents investors from getting caught up in quickly changing narratives in the media that can easily trigger emotional decisions.

With that said, if you have questions or concerns about first-quarter developments or if there is anything else we can do to help, please feel free to contact us. We are always here as a resource, and we appreciate the opportunity to serve our clients.

Index Trailing Returns

Source: Morningstar

(Green values are the top two values in each column; the orange values are the bottom two values in each column)