Summary

Market sentiment improved during October, as a more positive tone for U.S. equity markets returned versus the previous two months. US markets were up for the month of October, which featured the release of hotter-than-expected inflation data for September, mixed earnings results, and higher equity index pricing, with notable strength in industrial sectors. In November, U.S. equity markets rose with the prospects of inflation cooling and a smaller expected rate hike at the December Fed meeting. Major U.S. equity indexes closed out December in the red, marking the first down year for the S&P 500 in the last four years.

2022 was a challenging year for investors. Higher interest rates, war, recession fears, and inflation concerns influenced the markets, with long-term investors holding steady through the ups and downs. The volatility in the markets stirred emotions but investing based on emotion has historically tended to result in long-term under performance.

To help slow inflation, the Federal Reserve raised interest rates seven times in 2022, with four major hikes of 75-basis-points in a row. This is the most drastic increase in interest rates in decades, and while there are several indications that the higher interest rates are helping to moderate inflation, there are some concerns that the slowdown in economic activity from the higher interest rates will create a recession. The Fed has a to walk the delicate balance of slowing the economy to prevent continued price increases with slowing it too much that economic activity shrinks. From the indications they have provided to date, it seems that they are committed to slowing inflation even if it causes a recession.

Market Returns

At the end of the newsletter, we have included several tables that show rates of return for various market indices and asset classes. Table 1 includes broad index trailing returns. Overall in 2022, the large-cap S&P 500 was down 18.11%, its worst year since 2008, when it dropped over 38%. Core bonds were also down 13.01%, due to the rapid increases in interest rates throughout the year. The decline in fixed income asset classes is why even conservative investment portfolios experienced sizable declines throughout the year.

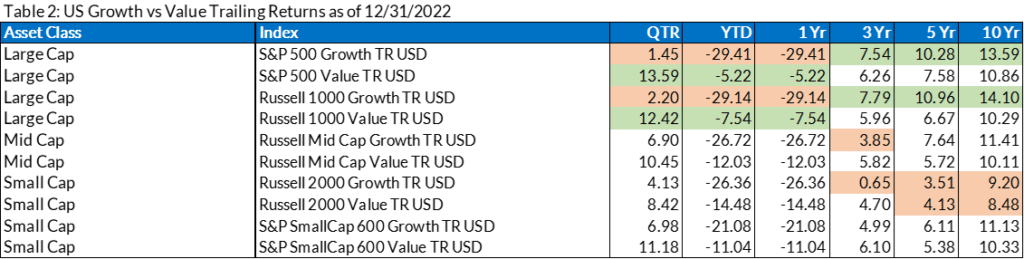

Table 2 breaks down US equity market returns into various segments based on size and style. The best performing asset class for the year was US Large Value, which was down in the single digits. The worst performing asset class for the year was US Large Growth, which was down over 29%. For mid and small cap companies, value also outperformed growth for the last quarter and for the year overall.

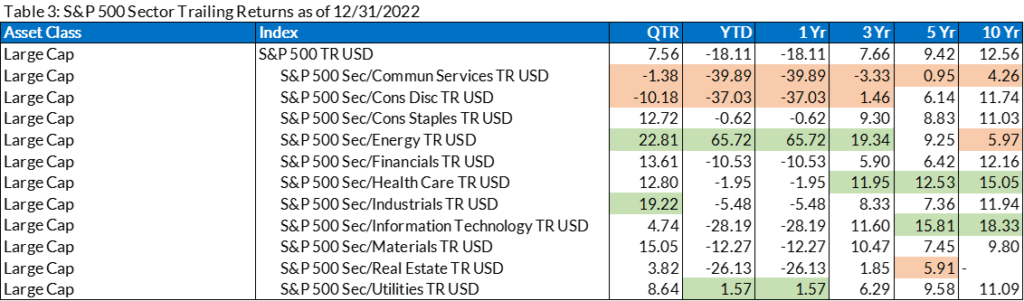

As seen in Table 3, the only S&P 500 sectors with positive returns for 2022 were energy and utilities. For the 4th quarter, all sectors had positive returns except communication services and consumer discretionary with energy and industrials leading as the best performers.

Interest Rates & Bonds

In November, the Fed delivered a widely expected 75-basis-point hike, making the effective federal funds rate 3.75% – 4.00%, which was in line with market expectations. Minutes from the November Federal Reserve meeting showed that the Fed was looking to change gears to smaller interest rate hikes “soon,” which they did in December, especially following the release that the Core Personal Consumption Expenditures (PCE) Price Index (a common measure of consumer inflation) in early December was below expectations. The December Fed meeting resulted in a 50-basis-point interest rate increase, with an effective funds rate of 4.25% – 4.50%. This week, the Fed is meeting again and is expected to raise rates by only 25 basis points, to a 4.50% – 4.75% level.

Government bond yields rose for the third straight month in October. The 10-Year Treasury Note Yield declined in November, its first monthly decline since July, yet it reversed course in December. Shorter duration bond yields behaved similarly, also declining in November but rising again in December. The 2-year/10-year yield curve remains inverted.

Earnings & Labor Market

According to data from FactSet, S&P 500 earnings showed 70% of S&P 500 companies reported a positive earnings per share (EPS) surprise for the third quarter. Earnings for tech companies tended to have softer earnings results than their industrial company counterparts. For example, Amazon missed analyst estimates for the third quarter and offered weak guidance for the fourth quarter. Earnings results were strong in the energy sector for the third quarter, with Shell Plc’s quarterly profits more than doubling.

Companies paid record dividends in 2022, increasing 10% year-over-year to $564.6 billion versus $511.2 billion in 2021, according to data from S&P Global Indices. Rising interest rates could continue to play a role in corporate dividend payouts in 2023. With the rise in 10-year Treasury yields, higher corporate dividends are expected in order to compete for investment capital.

According to the Bureau of Labor Statistics, U.S. jobs increased throughout the quarter and finished the year strong. Nonfarm payroll employment increased again in December, and the unemployment rate declined to 3.5%. Payroll employment increased at an average of 375,000 per month in 2022, which is less than the average of 562,000 per month in 2021.

Market Sentiment

The overall market sentiment shifted in October to a more positive slant for equities. Short-term market volatility subsided, with the CBOE Volatility Index falling throughout the quarter. When volatility falls, it usually indicates investor fears are subsiding. Some investors also watch the CNN Fear and Greed Index to gauge investor sentiment, which is not showing signs of investor fear as of this writing.

On the final trading day of November, the S&P 500 traded and closed above the widely watched 200-day moving average, which it had not closed above since April 2022. The 200-day moving average is calculated by averaging the closing prices over the previous 200 days. The metric is often used as an indicator of short-term market movement and can be informative about which way the market seems to be moving.

Since we take a long-term investment perspective, market sentiment is not a major influence in our investment management. However, being aware of the general market sentiment can be helpful in recognizing how investors at large tend to be feeling about the markets.

We believe it is wise to remain grounded and remember the long-term strategy we employ. Sticking to the investment plan regardless of overall market sentiment is historically prudent. Remembering this during times of market upturns is equally as critical as remaining resolved during market downturns.

Manufacturing

The last trading week of 2022 was quiet for economic data releases, but the Chicago Purchasing Managers’ Index provided an upside surprise: 44.9 versus a 41.0 consensus and a nice rise from the November reading of 37.2. While the metric still remains in contraction territory (under 50.0), upward movement is welcome, and the data comes just days after the Richmond Fed’s manufacturing survey showed modest improvement. A potential shift to “Made in the USA” could be underway, courtesy of supply chain issues.

The Takeaway

In the short term, the prevailing market themes remain centered around interest rates and inflation. Uncertainty over the global recession is still a factor in broad sentiment at the close of 2022. Higher interest rates are likely to persist early in 2023, and once the effects have sufficiently cooled the economy, the Fed could strike a different tone later in the year.

As we begin 2023, the year is off to a positive start, with most market indices and asset classes in positive territory for January, which historically has been a good sign for the year. We continue to take a long-run perspective to investing and believe that maintaining an investment in line with your risk tolerance is the best approach to accomplishing your future goals.

Index Trailing Returns

Source: Morningstar

(Green values are the top two values in each column; the orange values are the bottom two values in each column)