Summary

Over the past few months, stock markets have experienced wide fluctuations. After being down from the beginning of the year by over 23% through June 16, the S&P 500 gained 17% through August 16. Then, from August 16 through October 12, it lost 17%. As of this writing, the S&P 500 is up 11% since October 12. These are wide swings that may make even the most experienced investors a little nervous. What is causing the wide swings and how can the valuation of this broad basket of companies change so much from one month to the next? Changes in inflation expectations.

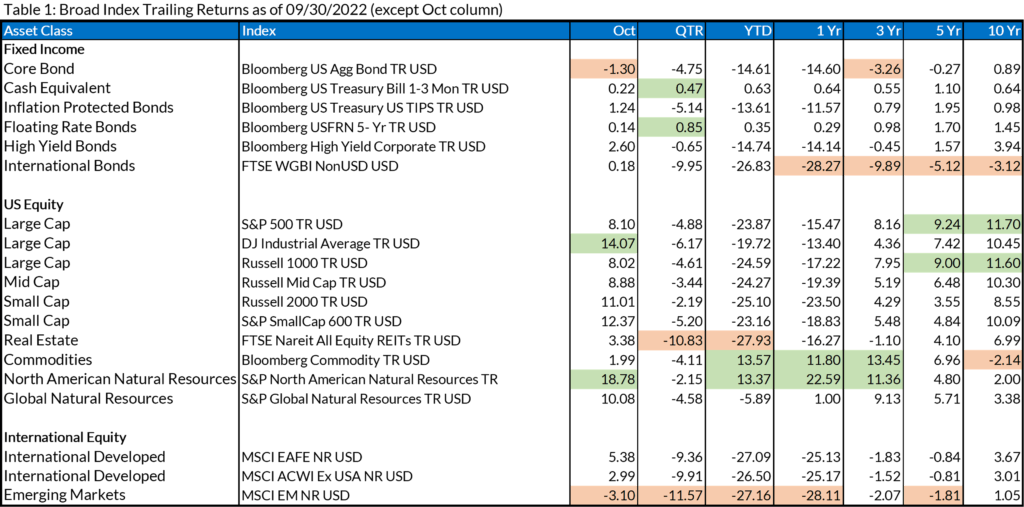

While a low to moderate level of inflation is desirable for a healthy economy, if inflation grows unrestrained, it can significantly challenge a country’s economic systems. As shown in Chart 1 below, since the COVID Pandemic, the United States is experiencing its highest level of inflation since the early 1980s. Note that a silver lining of high inflation for those receiving benefits is that Social Security, which is pegged to inflation, will increase by a record 8.7% in 2023 as an attempt to keep up with current price changes. In June of this year, prices were 9.1% higher than one year earlier. While this level of inflation is well above desirable, the bigger concerns are the uncertainty of how much higher inflation could go, and if so for how long, and how high will interest rates may have to rise to continue to get inflation under control.

Chart 1: US Inflation Rate 1933 – Present

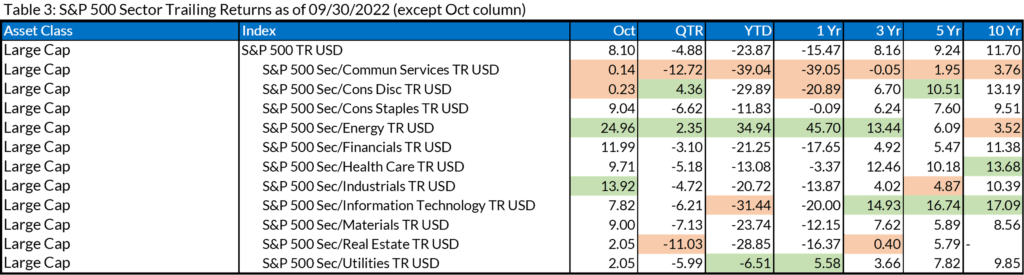

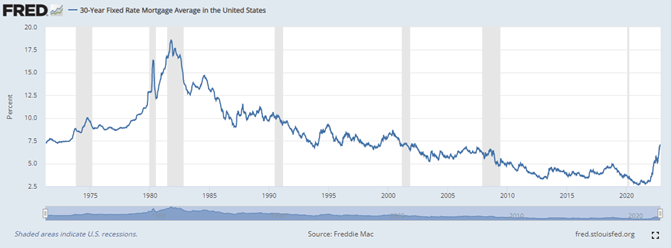

The main tool used to slow the economy and reduce or level prices is increasing interest rates. In the U.S., the level of interest rates is influenced by the Fed Funds rate set by the Federal Reserve as well as their buying or selling of bonds in the marketplace. The Federal Reserve uses these tools to accomplish their primary mandate of maintaining steady and stable inflation, and they’ve established a long-term target of 2%. In March of this year, the Fed Funds rate was at 0% and 30-year Fixed Mortgage rates were around 3.75%. Over the past 8 months, the Fed Funds rate was raised to 4% and 30-year mortgage rates have risen to around 7%. Charts 2 and 3 below show that, going back to 1955 and 1971 respectively, we have been at abnormally low interest rates since 2009 and that even with the abrupt increase we have experienced this year, rates are at or below historical averages. Even so, numerous data points indicate the higher interest rates are having the intended effect of slowing down economic activity and reducing or leveling out prices, but it remains to be seen if it will be enough to flatten out inflation. In September, Jerome Powell, the chairman of the Federal Reserve said, “We have got to get inflation behind us. I wish there were a painless way to do that; there isn’t.”

Chart 2: Federal Funds Rate 1955 – Present

Chart 3: 30-year Mortgage Rates 1971 – Present

We have all felt the discomfort of inflation and increasing interest rates, but is it almost over? Will the Federal Reserve know when to stop raising rates, or might they overcorrect by raising them too far, creating unnecessary pain? In January 2021, Jerome Powell, said, “When the time comes to raise interest rates, we’ll certainly do that, and that time, by the way, is no time soon.” In hindsight, one could argue that the Fed Funds Rate was kept at 0% for too long and waiting until March 2022 to start raising rates was a little late. These are the questions that are causing the market to fluctuate in value by around 20% every 2 months this year.

If raising interest rates to a manageable level can reduce inflation to the long-term target rate of 2% per year without bringing economic activity to a halt, equity values should react favorably. If instead, inflation proves persistent and the Fed Funds rate has to increase to unanticipated higher levels, we should expect an additional reduction in asset values. November 9th demonstrated this tug of war in the market when the October inflation reading came in at 7.7% over the prior year, which was lower than expectations of 7.9%. This fueled an increase of over 5% in the S&P 500 in a single day, which was on top of the rally over the 2nd half of October that resulted in the Dow Jones Industrial Average index posting its best month since 1976.

Our view on inflation is that despite the current year-over-year price increases being the highest we have witnessed in 40 years, inflation will moderate to a more reasonable level over the coming months and year. The combination of the slowdown in economic activity due to the increase in interest rates and the fact that prices in 2023 will be compared against prices from the same month one year earlier which already experienced a large increase, should reduce the inflation readings in 2023. Chart 1 shows that inflation goes through cycles with periods of high inflation followed by periods of more consistent price increases. We expect the U.S. will not remain in a state of this extreme inflation for an extended period.

In addition to inflation expectations lowering, we also view the recent mid-term elections and 3rd Quarter earnings as positive indicators for equities. The mid-term election appears to have resulted in a slight Republican majority in the House balanced by a slight Democrat majority in the Senate. This will likely result in legislative gridlock in Washington, which may be positive for markets. Historically, with a Democrat in the White House, the best market performance has come when there is a Republican majority in either the House, Senate or both. It is also interesting to note that, while there is no guarantee of future performance, the S&P 500 Index has posted a gain in each 12-month period after the midterm elections for 19 straight occasions since World War II.

As for third-quarter earnings, with 90% of the S&P 500 constituents having reported, 69% of S&P 500 companies had beaten analysts estimates, and the aggregate of all companies who have reported bested analyst estimates by 1.8%. This helped propel the rise in market values in October.

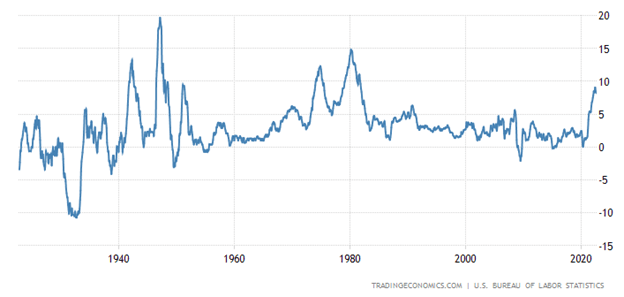

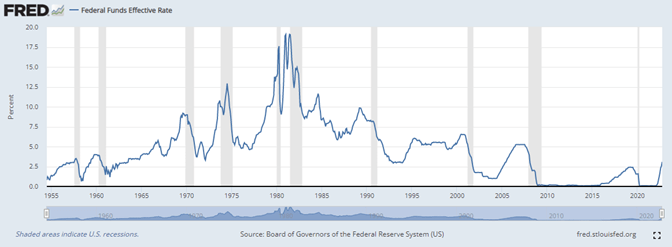

Table 1 below includes the returns for broad indices as of the end of September, with an additional column for October. Not surprisingly, values for the third quarter were down for most indices, with Cash and Floating Rate bonds providing the highest performance for the quarter, and real estate and emerging markets providing the lowest returns. However, the third-quarter earnings season began with a strong start in mid-October, which was a positive driver for the stock market in October. Table 2 below includes a comparison of growth and value indices, which highlights the variability in returns between growth and value companies over different time periods. It also shows that value stocks have recently been outperforming growth stocks. Table 3 provides a breakdown of the market returns by sector. The top two performing sectors for the quarter were Consumer Discretionary and Energy, and the worst two sectors were Communication services and Real Estate. Unexpectedly, with the rally in October, many of these trends remained the same with growth trailing value, etc.

Bond Markets

Similar to the Fed Funds Rate and 30-year mortgages, the benchmark 10-year Treasury yield has risen sharply over the past several months, hitting as high as 4.22%, although it has since settled to 3.72% as of the date of this writing. As interest rates rise, bond prices typically decline, resulting in higher bond yields and losses in bond investments. That said, while interest rates – and subsequently bond yields – have risen steadily recently, they are still below historical averages, and the interest rate expectations of the Federal Reserve have largely been priced into bond markets already.

Other Economic Data

The overall employment picture remains healthy, with non-farm payrolls adding 261,000 jobs in October, and an unemployment rate of 3.7%.

Crude oil prices dropped in September but have come back up and are now fluctuating between $80 and $90 per barrel. Gas prices have come down across the country but remain over 10% higher than one year ago and 40% higher than two years ago.

Takeaway

The past few months have featured substantial volatility due to the Fed’s outlook and expectations for further rate hikes. Inflation metrics remain elevated but are decreasing, and the Fed is continuing to adjust interest rates to slow price increases. When November’s inflation data is released in December, we will see whether inflation continues to decline, as it did in October. While the economic environment is challenging, and monetary policy is variable, easy monetary policy can’t remain easy forever, and tight monetary policy won’t remain tight forever. As we’ve seen before, long-term investors experience multiple cycles of expansion and contraction over their lifetime, and we continue to believe that the best course of action is to stay the course through rebalancing portfolios to target allocations based on your risk tolerance and maintaining a portfolio tailored toward meeting your goals, while also taking advantage of tax-loss harvesting opportunities. Thank you for being a client.

Index Trailing Returns

Source: Morningstar

(Green values are the top two values in each column; the orange values are the bottom two values in each column)