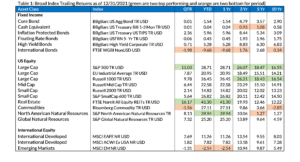

US stock markets showed continued resilience in the last quarter of 2021, albeit with its natural fluctuations along the way. Although October historically is one of the most volatile months of the year for stocks, it proved to be strong month. In November, markets continued the positive trend, until news of the new Omicron variant raised concern right after Thanksgiving. As inflation metrics showed increases during December, the positive performance of the markets served as a reminder of the benefit of balanced investment approach that includes an allocation to stocks. As seen in Table 1 below, all the US equity indices that we track ended the year with double-digit returns.

The Federal Reserve began tapering the pace of its monthly bond purchases in November, which were previously running at $120 billion per month. The purchases are scheduled to end in mid-March. The Fed had projected the need for increases to the benchmark overnight lending rate over the next several years, and the Fed Funds rate is projected to increase from current levels (0% – 0.25%) to 1.75% by 2024. Half of the Federal Reserve members now see the first interest rate hike in 2022, possibly as soon as March. The possibility that rates could rise faster than previously communicated has largely been responsible for the market downturns this month, particularly over the last week, in anticipation for the Federal Open Market Committee meeting that took place last week. Although they didn’t raise rates, the post-meeting statement indicates that they expect to raise the target range for the federal funds rate soon. It’s also worth noting that Jerome Powell was renominated for a second term as Federal Reserve chair. If approved, his new four-year term will begin in February, which many view would have a positive impact on the market.

While weekly unemployment claims metrics fell steadily throughout 2021, more recent U.S. non-farm payroll reports have displayed mixed results. Data released in October showed 194,000 jobs added during September versus the 500,000 expected. However, in November, non-farm payroll data showed the opposite for October, with 531,000 jobs created versus expectations of 450,000. The December non-farm payroll data showed 199,000 jobs created in December versus the 450,000 expected, although the U.S. unemployment rate improved to 3.9% in December, versus expectations of 4.1%, a fresh pandemic-era low. This is in line with the lower weekly unemployment claims we saw throughout 2021. In fact, claims fell to close to 52-year lows to end the year. It is a bit unusual, however, to see lower unemployment combined with fewer than expected jobs being added.

As 2021 closed out, the US Large Cap index, S&P 500, had an annual return of 28.71% and a three-year annualized return of 26.07% (see Table 1). We also look at other broad index trailing returns in Table 1 below. Over the last quarter, US Large Cap and Real Estate (REITs) were the top performing indices, while the lowest performing indices were International Bonds and Commodities. Over the 2021 calendar year, Real Estate and Natural Resources were the best performing indices, while International Bonds and Emerging Markets were the lowest performers. More long-term, US Large Cap has outperformed the other asset classes over the last three-, five-, and ten-year time periods.

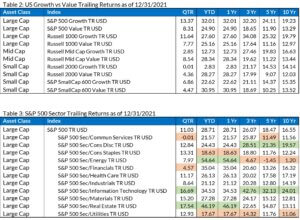

In Table 2, we take a closer look at Growth-oriented indices and compare them to Value-oriented indices. As we’ve seen over much of the last decade, Growth continues to outperform Value for US Large Cap indices; however, Value outperformed Growth for Mid Cap and Small Cap indices over the last year.

In Table 3, we take a look at the sector trailing returns and see that Information Technology and Real Estate were the top-performing sectors for the last quarter, while Utilities and Consumer Staples were the top-performing sectors over the last year.

In the short term, the prevailing market themes remain centered around inflation and job growth. Uncertainty over Omicron remains exactly that: uncertain. Higher interest rates are scheduled to become a reality in 2022 and will be partially dependent on the broader effects of Omicron on the U.S. economy.

As history continues to demonstrate, including what we have seen thus far in January, markets in the short-run tend to fluctuate based on changes in the economic data, world events, and consumer sentiment. Our consistent message to our clients is to remain fully invested according to target asset allocations, which is based on their risk tolerance, and stay focused on achieving their overall goals.

Index Trailing Returns

Source: Morningstar